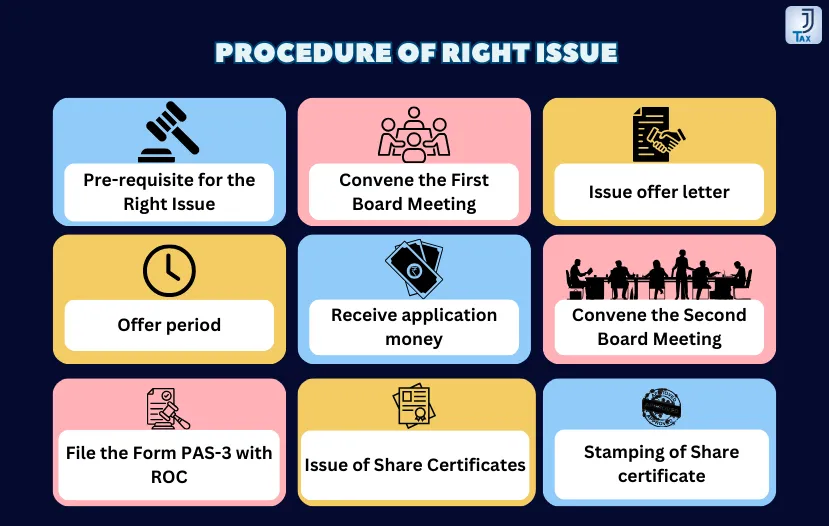

A Step-by-Step guide for successful share offerings to existing shareholders

As per Section 62(1) of the Companies Act, 2013, if the Company decides to issue further shares, these should be offered to existing shareholders in proportion to the existing persons who are holders of equity shares. ‘Right Issue’ means offering shares to existing members in proportion to their existing shareholding. This article examines the detailed procedure for a successful Right Issue of shares under the Companies Act, 2013.

Before commencing the Right Issue process, certain prerequisites must be addressed. These are: authorized capital should be adequate to cover the intended offer size, and drafting essential documents such as share application forms, offer letters, and letters of renunciation. Dispatch notice, along with the agenda for a board meeting, at least 7 days prior.

The board shall pass the resolution for Approving rights shares, issue Letter of Offers, to decide the proportion of right issue, to fix the issue price of the right shares, and to authorize

The Director/Company Secretary is to sign the documents.

The letter of offer must be dispatched to every existing shareholder at least three days before the opening of the issue. “Letter of Offer” includes the right of renunciation. Right of renunciation means the person to whom shares are offered has a right to renounce the shares in favor of any other person.

The offer shall remain valid for a minimum of 15 days and a maximum of 30 days. But in the case of a private company offer can be kept open for less than 15 days, provided 90% consent of the members is obtained.

Shareholders who wish to subscribe to the right issue of shares must submit their application forms and pay for the shares or renounce their right. Unsubscribed portion may be disposed of in the manner as the Board of Directors of the Company shall deem fit and in the best interests of the Company.

The company is required to schedule a second board meeting, with a notice sent at least 7 days in advance. It is essential to have the necessary quorum present, and the board must pass a resolution for the allocation of shares. Once the resolution for share allocation is approved, the shares must be allotted within 60 days of receiving the application funds.

The company must file the E-form PAS-3 within 30 days from the allotment of the shares with the Registrar of Companies. The certified true copy of the Board Resolution and the list of the allottees must be attached to the form.

The share certificates must be issued; if the shares are in Demat form, then the company must inform the depository immediately on allotment of shares. If the shares are held in physical form, then the share certificates must be issued in Form SH-1 within 2 months from the date of share allotment, signed by at least 2 directors.

Share certificates shall be stamped within 30 days of the issue of share certificates. You can refer to our article for the stamping of share certificates for the companies registered in Haryana.