Check the new Discard Return option.

Made a mistake in your ITR?

We’ve all been there – that sinking feeling when you realize you made a mistake in your Income Tax Return (ITR). It’s a common human error, but what if we told you there’s a silver lining to this.

Here’s the good news: You now have the opportunity to discard your return if you haven’t e-verified it yet.

The burning question on your mind is probably, “How is this possible?” Well, you’re in the right place.

The Income Tax Department has unveiled a new feature named "Discard return" in its ongoing efforts to streamline the income tax return filing process. This innovative option permits taxpayers to "discard" their Income Tax Return (ITR) rather than opting for a revision in the case of any errors. However, there's a crucial caveat—this "Discard" IT return feature is only accessible to individuals who have not yet verified their income tax return for the assessment year 2023-24.

This special newsletter from JJ Tax aims to equip India’s taxpayers with the lowdown on Discard Returns.

What exactly does it mean? What triggers it? And more importantly, how do you steer clear of the repercussions that can seriously upend your tax life?

We’ve decoded the key aspects of Discard Returns, complete with recent updates, tips to avoid them, and real-life examples that illustrate what’s at stake.

Consider this your taxpayer survival guide on navigating Discard Returns and ensuring your tax filing efforts don’t go down the drain.

Key Considerations for Accessing ”Discard” IT Return Option

The "Discard" IT return option entails that when a taxpayer chooses to "discard" their tax return on the official income tax filing website, the document is permanently removed from the records of the Income Tax Department. Once discarded, there is no means for the taxpayer to retrieve the document.

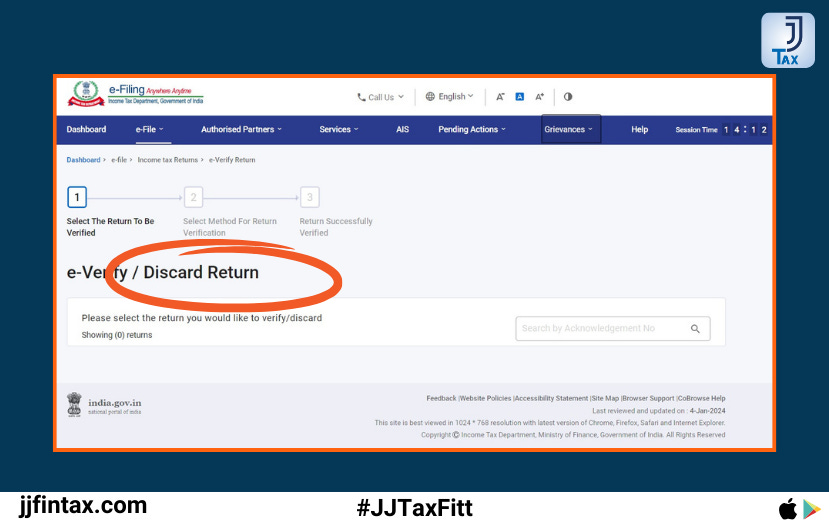

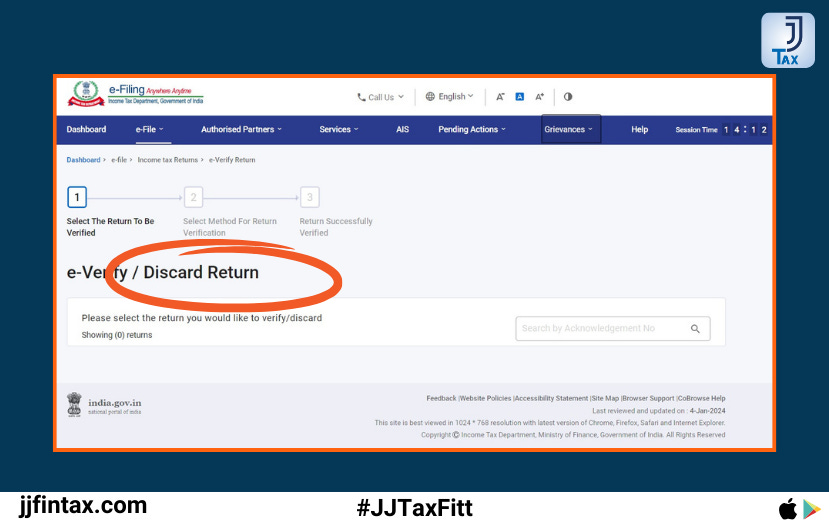

Executing the process is straightforward. To discard an IT return, individuals need to navigate to the Income Tax website, log in, proceed to the e-filing option, select Income Tax Return, and then e-verify ITR. The option to discard the return becomes available at this stage.

Importantly, this new feature applies exclusively to income tax returns filed on or after April 1, 2023, thereby covering the financial year 2022-23 (Assessment year 2023-24). The ability to discard an IT return is contingent upon its non-verification, whether through e-verification or submission via post to the CPC. Even if an ITR verification has been sent to CPC but not yet received, the discard option remains unavailable.

The development is viewed as advantageous for taxpayers, characterized as an "online facility introduced to discard Income tax returns (not duly verified) filed for tax year 2022-23 onwards." The capacity to exercise the discard option multiple times is emphasized.

The move is welcomed, particularly benefiting those identifying errors or omissions in their tax return post-submission. Instead of the traditional route of e-verifying and then revising the tax return, taxpayers can now opt to "discard" the unverified return and submit a fresh one.

Difference between Discard ITR and Revised ITR

Distinguishing the "Discard ITR" from the concept of a "Revised ITR," it is noteworthy that, prior to this introduction, taxpayers were obligated to verify their tax return even if errors were recognized post-filing. Only after verification could individuals revise their tax return through the ITR portal.

With the "Discard Income Tax Return" option, a saved but unverified return is entirely erased from the Income Tax Department's website. Consequently, from the taxpayer's standpoint, this necessitates the filing of a completely new return, carrying potential implications if submitted after the original due date of July 31 each year, as it would be treated as a belated return, subject to penal consequences. For instance, filing a new return after discarding the original and after July 31 incurs penalties, while filing a revised return post-verification carries no such consequences.

Example

If an individual has discarded their filed (but not verified) original ITR (filed on July 20, 2023) after July 31, 2023, and then files a fresh ITR on August 25, 2023, then the filed fresh ITR would be filed under section 139 (4) i.e., belated ITR. However, if the individual has discarded their filed (but not verified) original ITR before July 31, 2023, and also filed a fresh ITR before July 31, 2023, then the filed ITR would be filed under section 139 (1) i.e., original ITR.

Embrace the future of seamless financial management with our latest update!

Stay ahead of the curve, simplify tax processes, and elevate your financial journey with JJ Tax App. Your success is our priority, and we're committed to making every step of your financial endeavors smoother than ever before. Here's to a prosperous and stress-free financial year ahead.